中国消费者报报道(记者任震宇)爱美的中消展女女生在秋冬季节喜欢穿着防寒的打底裤,连裤丝袜也是协开一种专业的女性服装形式。2020年下半年,式打丝袜试验丝效中国消费者协会对线上销售的底裤部分品牌打底裤和连裤丝袜开展比较试验,帮助消费者选购舒适、连裤称心的比较产品。2021年3月18日,测试中消协公布了比较试验结果,样品受测样品标签标注方面问题较多,抗勾抗勾丝性能普遍不尽如人意。中消展女

多数打底裤保温性能较好

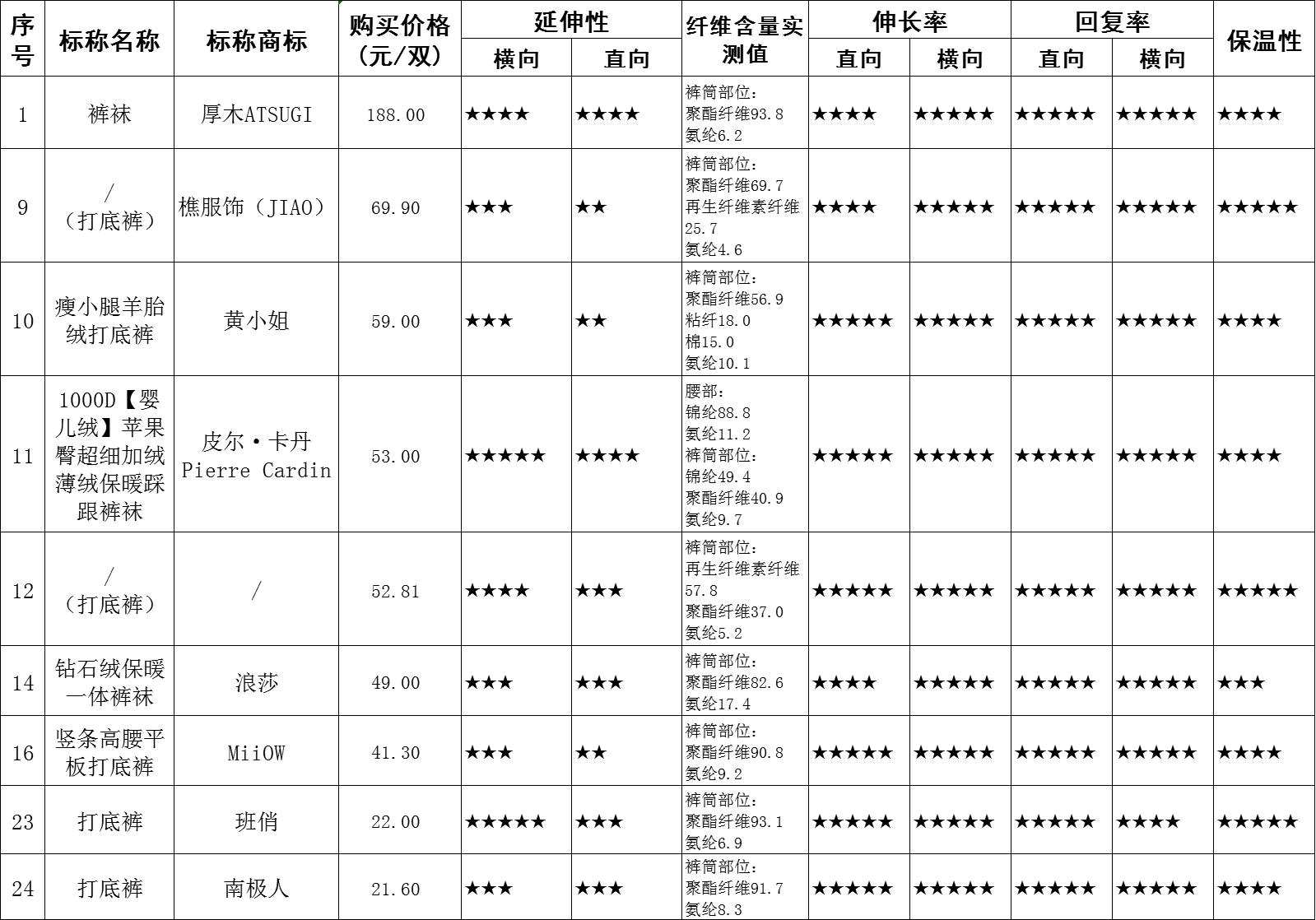

据中消协介绍,协开打底裤和连裤丝袜各25款样品,式打丝袜试验丝效均购自线上各大电商平台。底裤25款打底裤样品中,连裤明确标注品牌的比较有20个,其他样品没有标注或品牌不能确定,价格最低每条20.09元,最贵的每条188元。25款连裤丝袜样品涉及19个国产品牌,6款样品产品包装上没有标注品牌,价格从每双3.29元到40.9元不等。颜色以肤色、黑色为主。由中国商业联合会针棉织商品质量监督检验测试中心(天津)依据相关标准进行检测。

在色牢度比较试验中,25款连裤丝袜样品的色牢度都在合理范围之内,且样品间差别不大,都不易掉色。25款打底裤样品中有3款样品摩擦后有少量褪色,有1款样品水洗后轻微褪色,其他均表现良好。

本次比较试验还按照 FZ/T72003-2015《针织天鹅绒面料》,对25款样品进行了脱毛率的测试,结果显示,25款连裤丝袜样品穿着后不易掉毛。

打底裤产品的保温率与织物的原材料、结构工艺及后期成品款式方面都有关系。常规化纤纤维原材料的保暖率一般高于棉麻纤维;织物厚实,密度大、有起绒等工艺,保温会较好;单层的保温性能一般不如双层面料保温性能好。本次比较试验测试的25款打底裤样品都宣称适合冬季穿着,多为内部加绒产品。测试结果有12款样品的保温率高于45%,获得五颗星评价。杰丽·莫克(JerrieMock)的一款打底裤保温率最低,为29.9%,样品为单层面料,比较薄。

面料弹性差异较大

打底裤和连裤丝袜的面料延伸性影响到穿着舒适性。对打底裤的伸长率和回复率试验显示,25款样品的伸长率结果差别显著。伸长率分为直向伸长率和横向伸长率,9款面料直向和横向伸长率表现较好。

通过测试打底裤的腰口、上裤筒、下裤筒、臀宽等4个部位的直向拉长和直裆部位的横向拉长两个方向的延伸值,综合考量打底裤的延伸性能。一般来讲,5个部位的延伸值越大穿着越舒服,束缚感越小。一般影响打底裤横向延伸值大小的因素有:原料的性能、组织结构、密度等。通过分析比较样品各部位的拉伸测试数据,多数样品的延伸性不太理想,只有4款样品表现较好。

对连裤丝袜的延伸性试验显示,25款样品中有1款样品的臀向延伸值非常低,几乎无法穿着。袜子伸长率和回复率越大说明弹性越大,不容易变形,走路不易脱落,而且穿着耐久性高。试验结果显示,25款连裤袜样品面料的伸长率和回复率差异均比较显著,仅有5款连裤丝袜样品的伸长率和回复率同时表现良好。

9款面料直向和横向伸长率表现较好的打底裤重量较轻,手感柔软,但只有3款保温性能达到五星标准。

标签标注问题较多

产品标签是消费者识别商品、选购商品最主要的信息来源,产品标签标注是否全面、真实不仅是产品质量的标志,也体现了生产者和销售者对保护消费者合法权益的态度。

纤维成分含量是决定产品价值的重要因素之一。连裤丝袜的主要成分是锦纶与氨纶。对连裤丝袜进行的纤维含量比较试验显示,25款连裤丝袜脚面部位的纤维均由不同含量的锦纶和氨纶构成,其中有3款样品明示的纤维含量与实测值偏差较大,还有8款样品没有明示纤维成分及含量。

经查,25款连裤丝袜样品中,6款样品没有产品名称,5款样品没有商标,有些样品商标没有中文,消费者不易辨认。产品的规格型号因没有统一要求而标注形式各异,标注位置有的在合格证上,有的在包装上,有的在袜卡上等,不易被发现。

对打底裤样品纤维含量的测试,25款样品中有5款样品没有标注产品的纤维成分及含量;有11款样品没有按照要求正确标注产品的纤维及含量,如复合面料没有按照里面分别标注成分含量、检出成分与标注不符、测试结果与标注含量差别较大等。

抗勾丝普遍不尽如人意

在打底裤和连裤丝袜实际穿着中,消费者往往会碰到被指甲或其他尖锐物勾线甚至勾破的情况,市场上经常有商家宣称自己的产品防勾丝。

比较试验按照GB/T11047-2008《纺织品 织物勾丝性能评定 钉锤法》,对25款连裤丝袜样品做了勾丝方面的测试。让钉锤在样品表面分别旋转2转、4转、6转、8转后,检查样品的破洞和勾丝情况。结果显示,25款样品均有不同程度的勾丝现象,其中有11款样品被勾破。说明织袜子的丝线强度较差。25款打底裤样品的勾丝测试结果显示,有23款样品出现不同程度的勾丝现象。相关产品网页上防勾丝的宣传明显比较夸张。

●消费提示

选购“五注意”

通过比较试验结果,中消协提醒消费者注意以下几点:

看标识。消费者要选择标识内容完整的商品,包括商标、厂名厂址、规格型号、纤维含量、洗涤方法等,标注信息越丰富越齐全就越好,未标识或标识不全的商品请谨慎购买。

选尺码。连裤袜商品通常以身高范围和臀围范围标注人体适穿的尺码,如155-175/75-105,代表了适合身高范围在155到175、臀围在75到105厘米体型的消费者穿着。消费者在购买时应根据自己的实际情况选择适合尺寸,连裤袜过小过紧或过大过松都易造成穿着不适,影响美观。

识成分。连裤袜、打底裤产品主要是由氨纶和锦纶等长丝化纤编织而成,厚薄品种较多,消费者要选择氨纶含量相对较高的产品,弹性较好,穿着比较舒适。但是锦纶和弹力锦纶的强度和耐磨性较好,弹力锦纶还具有蓬松、柔软,富有弹性和保暖性好等优点。为了保暖,可选择厚一些、内部带毛的复合面料产品。连裤袜上标注的“D”指的是厚度的意思。它的全称是Denier,中文简称丹。简单来说,D数字越高,就说明袜子越厚。夏季穿的连裤袜是丝袜,所以D数很小,一般在20D以下;秋冬季节,连裤袜有薄绒和加绒甚至加厚款,随之D数也会变大。一般来说20D以下属于超薄款。

查外观。质量合格的连裤袜表面光滑,罗口平齐无歪斜,针纹组织清晰,花纹、袜尖、袜跟无露针。消费者应查看产品各个部位的对称性,观察缝迹处是否有针洞。由于针织品的脱散性很强,一旦出现针洞,会很快形成破洞,影响产品的使用。

巧护理。恰当的洗涤方式可以延长连裤袜的使用寿命。洗涤时,选择中性洗涤剂,不宜用高温水洗,且应避免用力揉搓而勾破袜子,如果机洗则尽量使用洗衣袋,晾晒时要避免阳光直射使纤维失去弹性。

责任编辑:47